Who Else Wants Info About How To Buy Covered Calls

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered calls offer investors three.

How to buy covered calls. Selling a call option against your long stock creates a steady stream of income for your portfolio. Ad free patented option search engine. Learn how to sell covered calls.

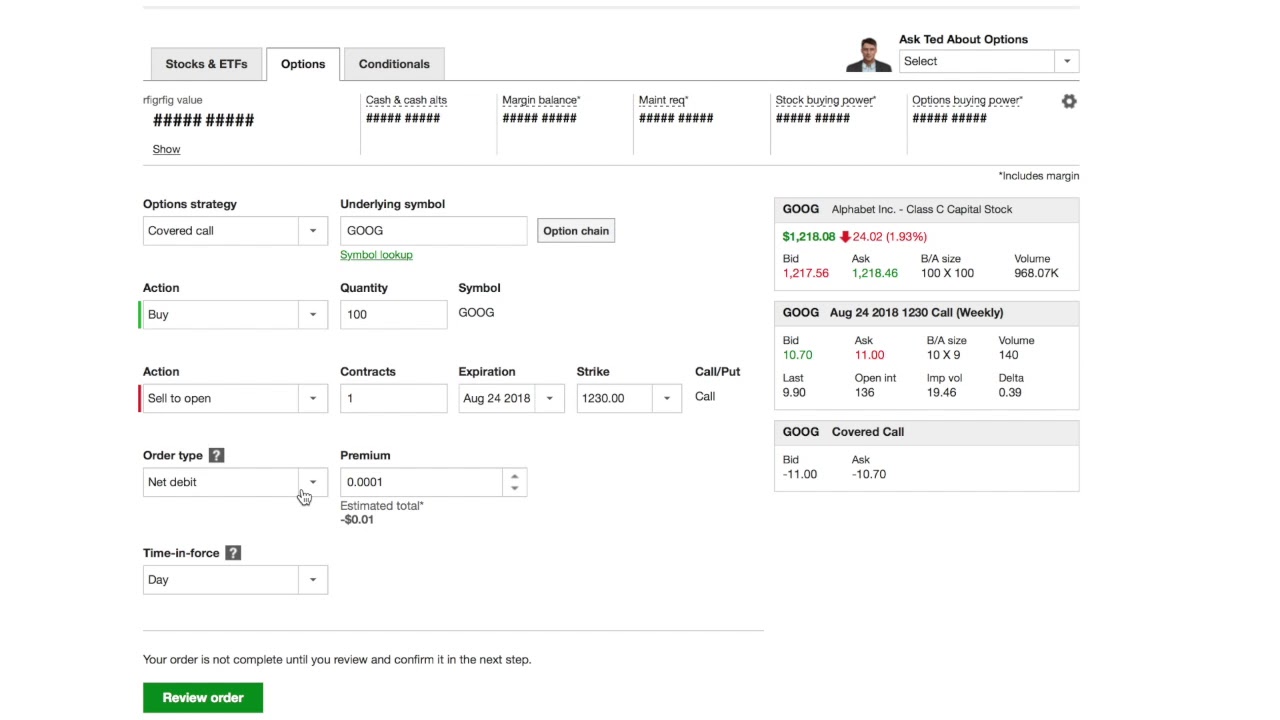

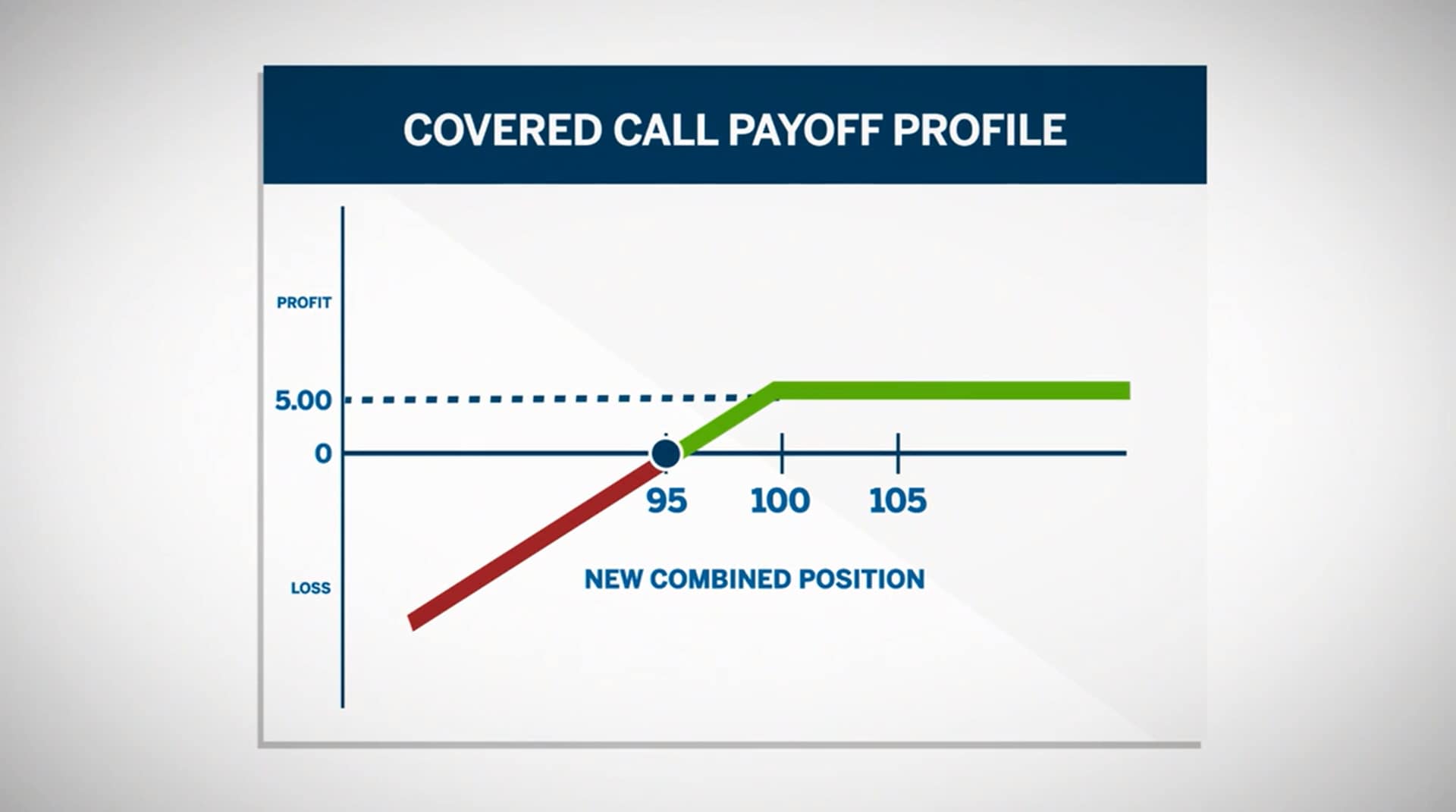

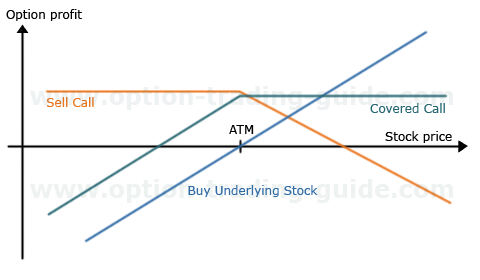

For a call option, the general rule is that the lower the strike price, the higher the call premium (because you obtain the right to buy the underlying stock at a lower price). Investors sell covered calls by writing a call option and owning the underlying asset. Sell 10 xyz apr 75 calls @ $2.00 (note that each standard call or put generally represents 100 shares of the underlying stock, thus, the 1,000.

In this video we walk through. Ad top rated stock market school. Robinhood is a popular platform among beginner options traders but they do make it difficult to trade advanced options orders.

To set up a poor man’s covered call, a trader will: For instance, if you purchase a stock for $39.30 per share and sell a 40 call for 0.90 per share, you receive a total of $40.90 if the covered call is assigned. Covered calls aren't some panacea.

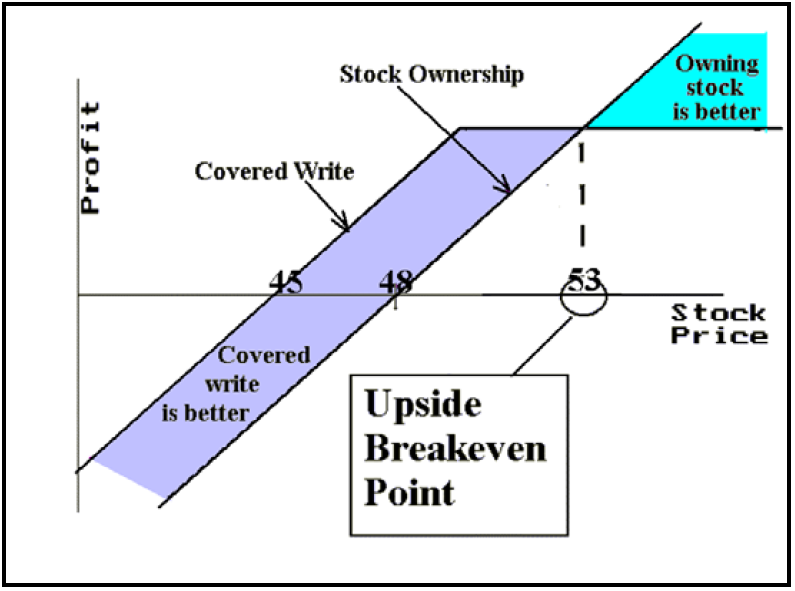

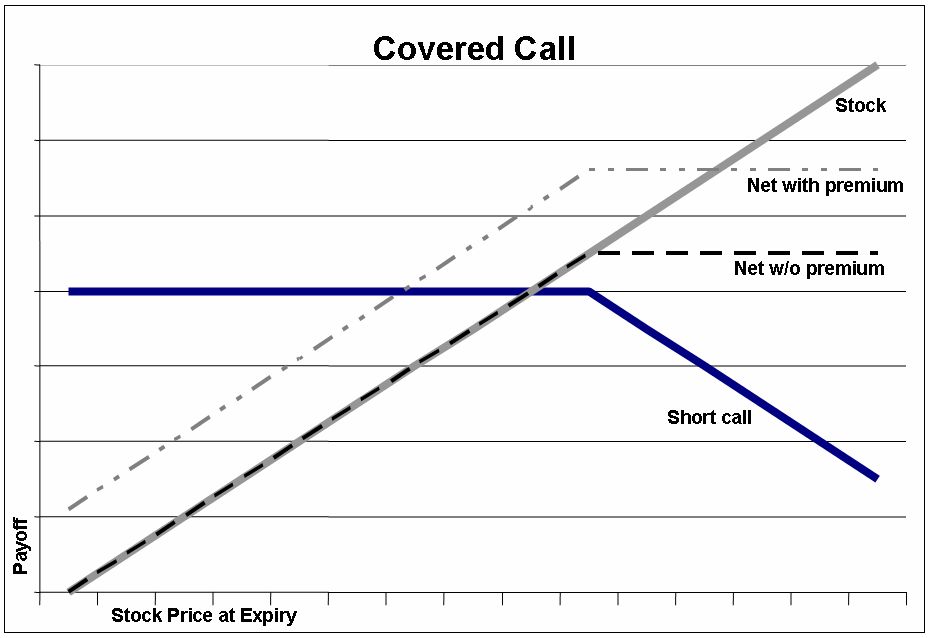

They limit your risk to the downside and reward to the upside. If the asset price doesn’t reach the strike of the call, the investor makes money. Selling covered calls is a strategy in which an investor writes a call option contract while.

Selling covered calls is the practice. 💎get up to 12 free stocks valued up to $30,600 when you open and fund a new webull account! Buy 1,000 shares of xyz stock @ $72 per share.

:max_bytes(150000):strip_icc()/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

![What Is A Covered Call? [Infographic] – Accessible Investor](https://accessibleinvestor.com/wp-content/uploads/2020/07/Covered-call-diagram-what-is-a-covered-call-AccessibleInvestor.com_.png)

:max_bytes(150000):strip_icc():gifv()/Cover-call-ADD-V1-551e4fa02e3a4af2bb0768956e8c0cc7.jpg)

![Covered Call Strategy Guide [Setup, Entry, Adjustment, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/60f0b09f1ba2ba99c9c89286_Covered%20Call%20resize.png)