Outstanding Info About How To Reduce Collection Period

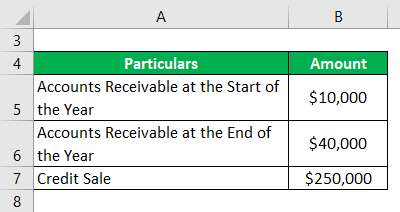

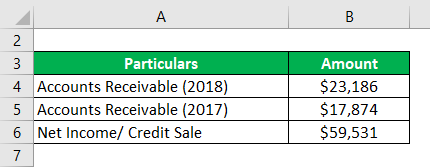

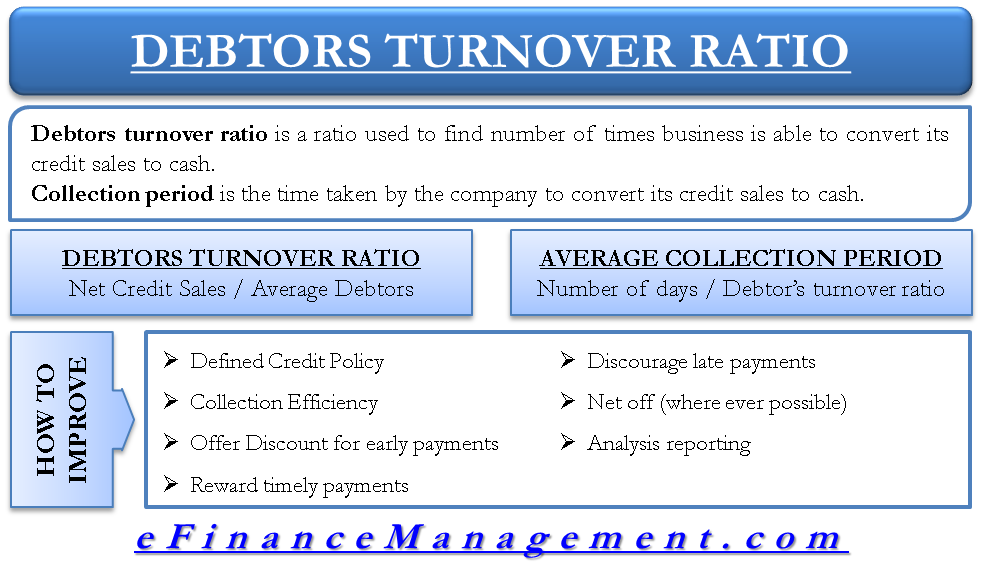

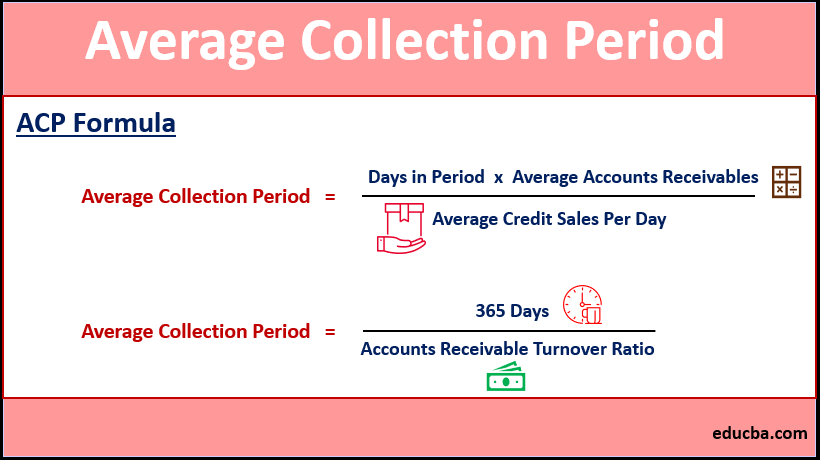

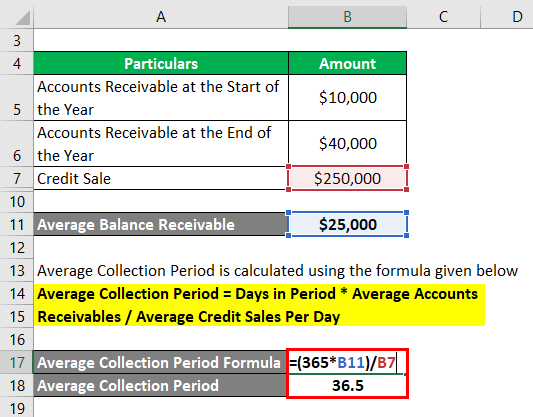

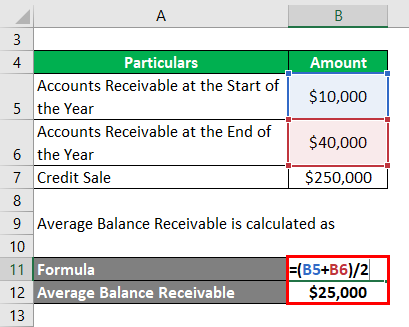

Debtor / receivable turnover ratio = credit sales / (average debtors + average bills receivables) formula for average collection period average collection period = (365.

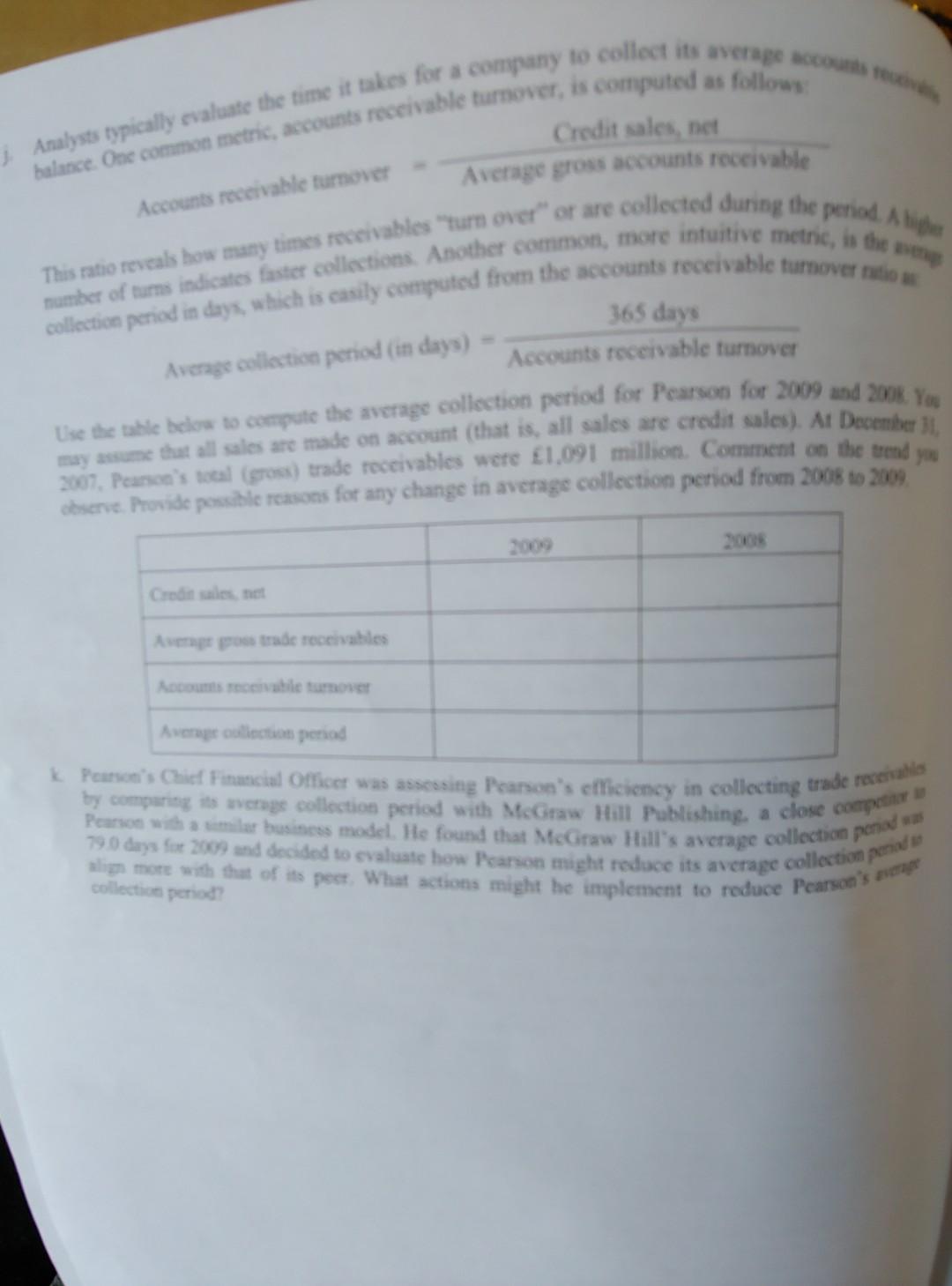

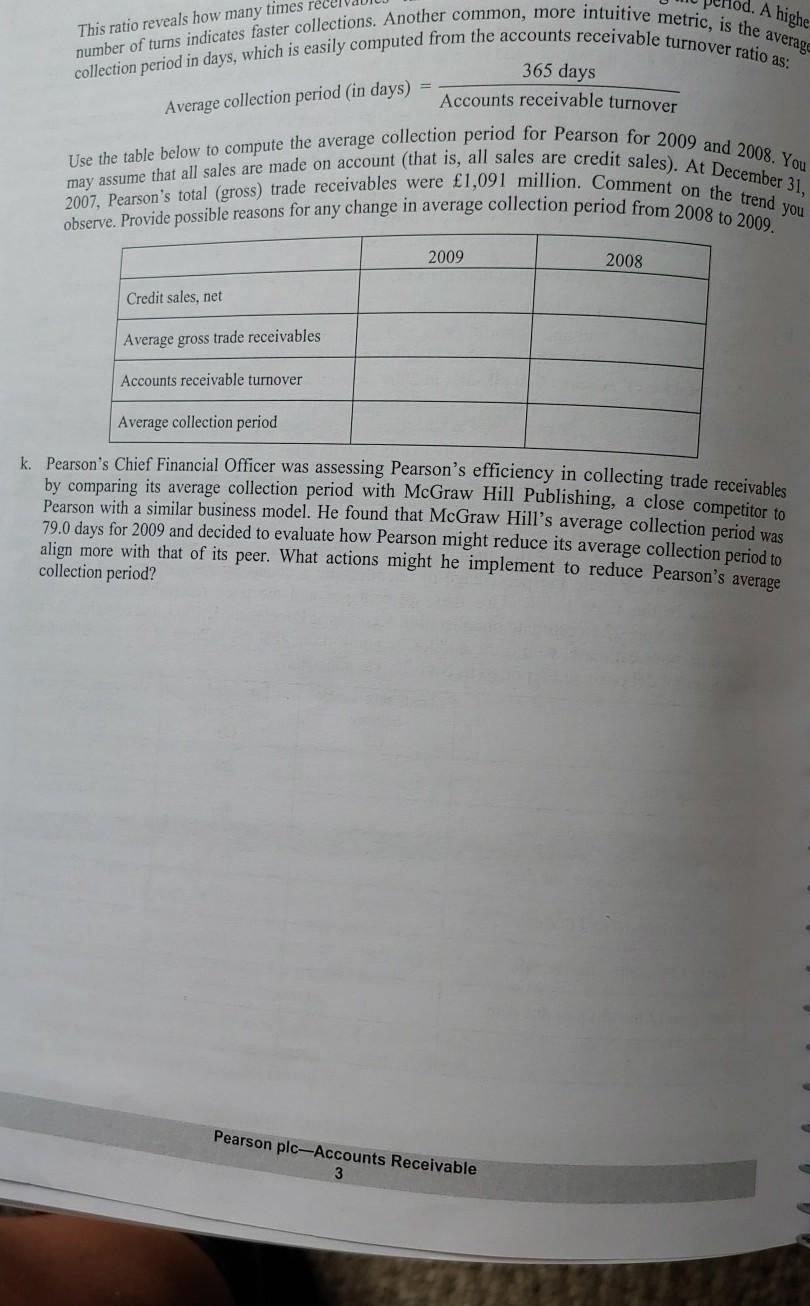

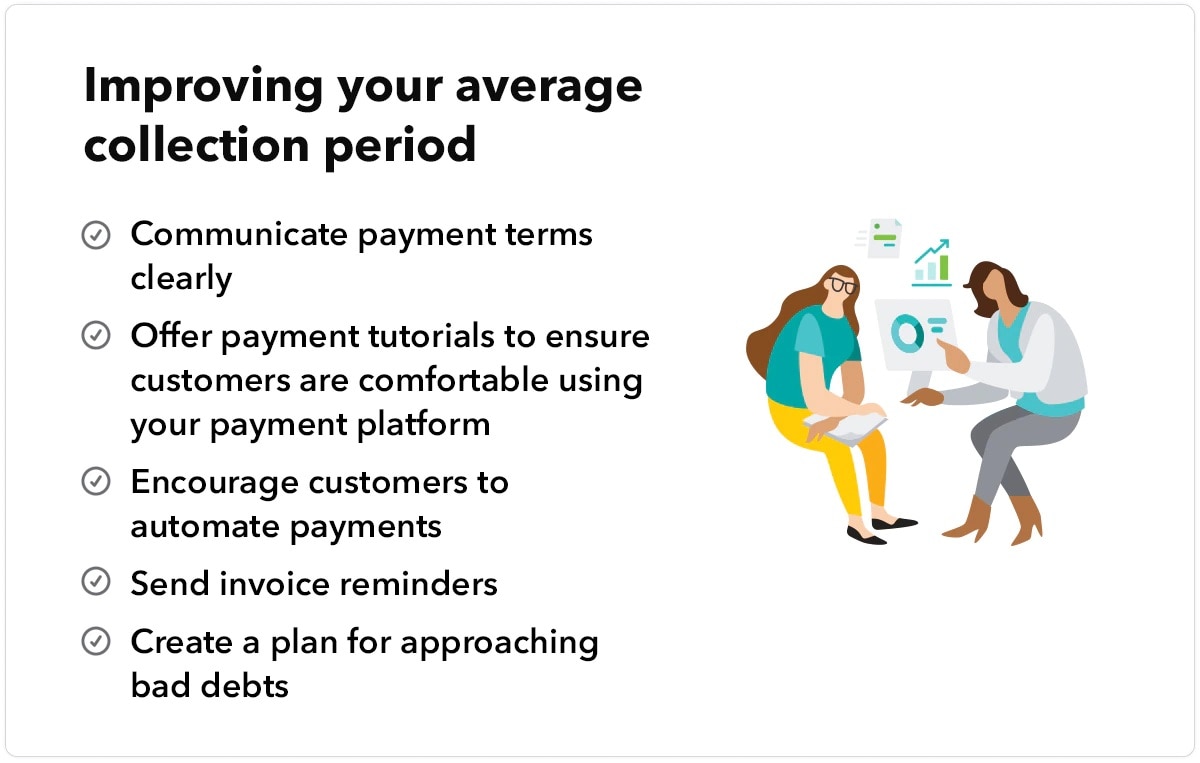

How to reduce collection period. If you are using a period of 1 year, you should be using 365 days in the period. It can reduce this delay by one to. How can a company improve its average collection period?

It can set stricter credit terms limiting. A company can improve its average collection period in a few ways. Avoid sarcastic remarks and name calling.

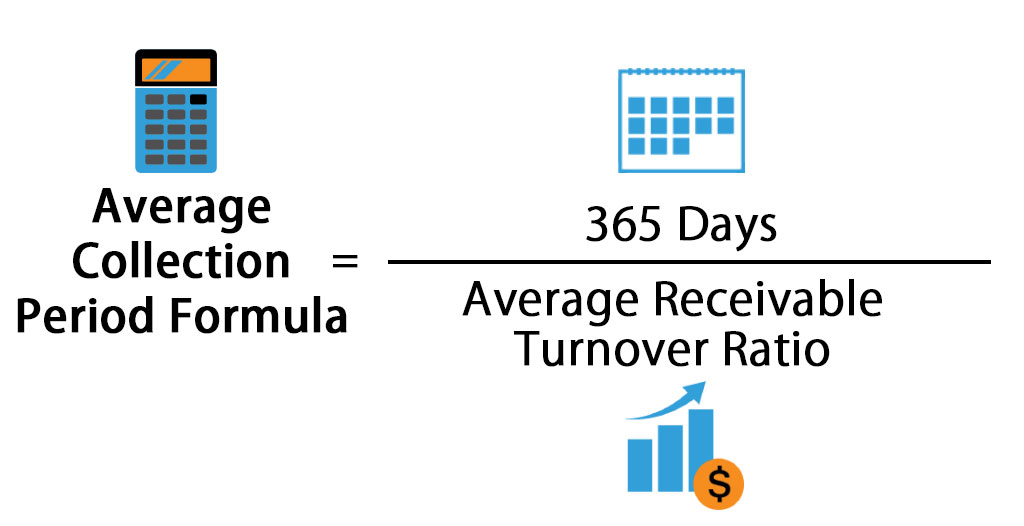

Collection period = 365 / accounts receivable turnover ratio; Here are a few things you can do to promote timely payments. Also, remember that there is a difference between net sales and net credit sales.

One way to avoid the check is in the mail excuse is to. How to reduce your average collection period. Period blood acts as a natural lubricant.

Act in a businesslike fashion. The quotient, then, must be multiplied by 365 because the calculation is. Here are a few things you can do to promote timely payments.

If the contract requires that a debtor makes payments every 30 days, then it follows that the average collection period will tend toward 30 days. The first step to determining the company’s average collection period is to divide $25,000 by $200,000. Up to 10% cash back using a post office box is one way to accelerate the payment and deposit portion of the cash conversion period.

:max_bytes(150000):strip_icc():gifv()/AverageCollectionPeriod_Final_4201163-b8c6c4e366854998922cf19de6da84b8.png)

![Average Collection Period - [ Formula, Example, Analysis ] - Calculator](https://invest-faq.com/wp-content/uploads/2019/08/average-collection-period.jpg)